The coronavirus pandemic, the Ukraine War, supply chain issues, inflation, rising interest rates and recession fears. Put them all together and what do you have? The economic volatility and financial uncertainty that we saw in 2022.

But if there’s an industry that can still thrive through adverse economic conditions, it's biopharma.

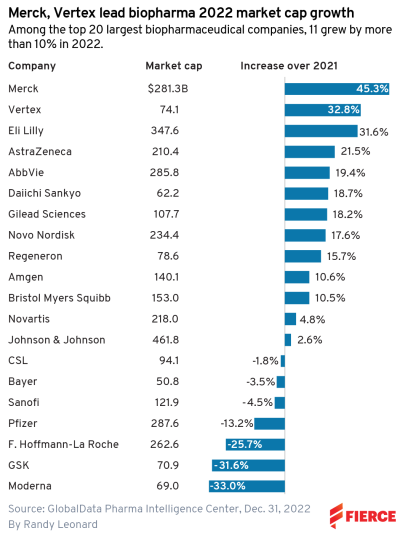

One measure of performance—or more precisely of investor confidence—is market capitalization changes. A snapshot view of top biopharma companies—comparing their market cap at the start of the year to the end—shows that 13 of the top 20 saw increases, including 11 with double-digit gains, according to research from data analytics and consulting firm GlobalData.

In the aggregate, the market cap of pharma’s 20 largest companies totaled $3.61 trillion on Dec. 31, 2022, a 5.4% increase from the same date the previous year.

This was particularly noteworthy considering how many other industries tanked in 2022. Among the 500 companies in the S&P 500 index, for example, there was a 19.4% aggregate drop in market cap. Meanwhile, the tech-laden Nasdaq index saw a 33% drop.

Pharma’s comparatively strong performance came despite another factor that introduced uncertainty, as the Inflation Reduction Act took the industry by surprise with several measures designed to restrain drug prices.

The Big Winners

In market cap terms, the biggest winner last year was Merck with a 45% gain. The jump may come as a surprise considering the consternation over the loss of exclusivity for cancer superstar Keytruda in 2028.

But the rise demonstrates investor confidence—not only in Merck’s development of a subcutaneous formulation of Keytruda which could extend its patent protection—but also in its pipeline and business development efforts. Last year, Merck was quiet in the M&A market but its $11.5 billion buy of Acceleron at the end of 2021 is looking like a savvy acquisition with the progression of potential cardiovascular blockbuster sotatercept.

Merck’s boost also could be something of a course correction after the company saw market cap losses in each of the last two years.

Like Merck, investors are still flocking to AbbVie despite the impending loss of patent protection for a mega-blockbuster. Despite newly launched Humira biosimilars, there apparently is growing confidence over the potential of Rinvoq and Skyrizi, the treatments the company has touted as the heir apparents. AbbVie's market cap grew 19% last year.

As for Eli Lilly, whose share price jumped 32% in 2022, the company is riding a wave of momentum as it approaches a year where it could score four FDA approvals—including high-profile nods to treat obesity and Alzheimer’s disease.

Novo Nordisk also saw a double-digit percentage share price gain. The company's obesity treatment Wegovy should be ready to take off after Novo struggled to meet demand because of manufacturing problems.

AbbVie, Lilly and Novo Nordisk are among a select group of companies that have had market cap gains each of the last three years.

Another big winner was Vertex, whose share price gained 33% in 2022. The company is taking flight with the anticipated success of potentially game-changing cystic fibrosis treatment Trikaftra/Kaftrio.

AstraZeneca and Daiichi Sankyo also saw sizable increases in their market cap, due in no small part to the growing potential of their partnered cancer treatment Enhertu.

Regeneron took a hit when the FDA sidelined its COVID-19 antibody treatment REGEN-COV, but the continued success of mega-blockbusters Dupixent and Eylea has helped regain investor confidence. Its share price climbed 16% last year.

The Big Losers

The precipitous drop in demand for COVID-19 vaccines was an obvious reason for the market cap plunges by Moderna, which fell by 33%, and Pfizer, which saw a 13% drop. Corrections were perhaps inevitable considering the huge market cap gains the companies had in 2021—149% and 62% respectively.

Roche fell into the same bucket. After a 32% market cap gain in 2021, fueled by the company’s success with COVID-19 testing products, Roche saw a reversal last year with a 26% valuation loss, which also was brought on by the clinical flop of two Alzheimer’s candidates.

Meanwhile, GSK’s market cap drop of 32% can be attributed to several issues, including pipeline troubles and investor activism surrounding the overall direction of the company.

Johnson & Johnson still No. 1

Closing 2022 with a market cap of $462 billion, Johnson & Johnson remains the big kahuna in the biopharma industry. Its growth has been slow and steady over the last three years with single-digit market cap gains.