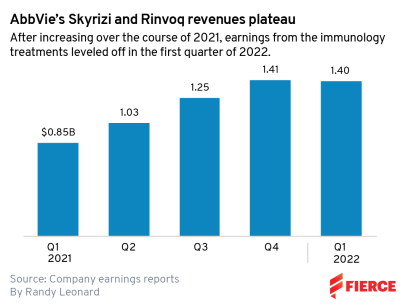

As AbbVie gears up for Humira's loss of exclusivity next year, investors are keeping a close eye on its successor immunology franchises. In the first quarter, one key med failed to live up to analyst expectations.

Rinvoq, the company's JAK inhibitor approved in four immunology indications, pulled in $465 million during the period, a 57% increase year-over-year. However, the med's sales fell below analysists consensus estimates of $490 million.

AbbVie's other new stalwart immunology med, Skyrizi, pulled in $940 million during the quarter, an increase of 65.6%. That was more than enough to meet consensus estimates of $909 million.

While Rinvoq failed to meet analyst expectations during this past quarter, AbbVie is steadfast that the meds can deliver $15 billion combined by 2025. That'll be key as Humira revenues start to erode next year in the U.S. thanks to biosimilars.

“We are very confident that we are going to get to high levels of paid access for Rinvoq and Skyrizi,” AbbVie's chief commercial officer Jeffrey Stewart said on a Friday conference call.

As for Humira, the megablockbuster's first-quarter revenues came in at $4.74 billion, missing analyst estimates of $4.9 billion. Its international revenue decreased 18% to $743 million thanks to biosimilar competition. Worldwide, the med's sales fell 2.7% on a reported basis.

“The Humira fundamentals and the market fundamentals are quite strong,” Stewart said. “In some cases, Q1 can be quite unique over the years, you see some co-pay and deductible dynamics, but we think that’s really a first quarter type of event and it’s largely been very consistent with what we’ve expected.”

AbbVie’s immunology portfolio contributed $6.141 billion in total, an increase of 8.1% on an operational basis.