By Cytiva

Despite rising R&D spending, drug approvals continue to fall. What can the biopharma industry do to improve its return on investment?

The process of bringing a new drug to patients is long, complex, and uncertain. The average pre-tax cost of developing each new prescription drug is estimated at $2.6 billion, and drug approvals continue to fall.1 To maximize the chance of clinical success with a robust and promising drug pipeline, R&D efforts should be cost-effective, streamlined, and collaborative.

Of all five industry pillars Cytiva examined for our 2023 Global Biopharma Resilience Index, the R&D ecosystem is the weakest, declining sharply from 6.54 in 2021 to 5.22 in 2023. This drop reflects ebbing confidence in the culture of collaboration and technological capability that enable the rapid development, testing, and scaling of new research.

The solution to this challenge may lie in the recent past: The global biopharmaceutical industry’s response to COVID-19 demonstrated the potential of focused collaboration and highlighted R&D’s vital role in combating unprecedented health challenges. In addition, new technologies, as well as emphasizing the role of R&D, may reverse the trend of falling drug approvals.

How a focus on collaboration versus competition can change the R&D landscape

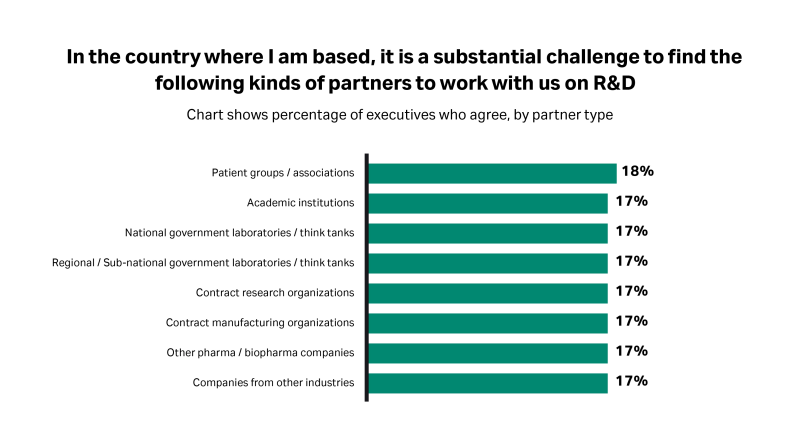

Effective collaboration in identifying, testing, and commercializing new medical products could open up new horizons for the global biopharma industry. However, respondents cite collaboration as a major challenge. In fact, the research suggests that cooperation and open innovation are rare commodities in the industry and pharma executives are even less positive about this key factor than they were in 2021.

“We have a lot of handpicked collaborations with companies, and we’ve been quite lucky. But collaboration involves a whole spectrum of interactions,” observes Leszek Lisowski, a molecular biologist specializing in developing and optimizing viral vector technologies at the University of Sydney Children’s Medical Research Institute. “A lot of companies, by their nature, have to be competitive. They have to hide their research; they cannot just share all their data,” he says

Fig 1. Around two in 10 executives report that it is a substantial challenge to find industry partners willing to work with them on R&D.

Scientific research is inherently international, and Killian O’Driscoll, Chief Commercial Officer at Ireland’s NIBRT (National Institute for Bioprocessing Research and Training), points out that strong international cooperation is often a requirement for funding programs. He adds, “The counterbalance is that each country wants to attract large scale manufacturing investments. Biopharma manufacturing are prized investments, so there is a degree of competition as well.”

Wenjie Zhang, Chairman and President of Henlius, a global biopharma company headquartered in China, believes that this competitive spirit is intensified by the heightened geopolitical tensions. However, he is still hopeful that “collaboration can be across the boundary of countries and politics.”

China’s domestic market, Zhang emphasizes, is “still some way from true innovation.” It is basic research that is required to fill that gap. “The majority of public or private funding for basic [life sciences] research comes from the US, so we're pretty weak in terms of supporting the basic research, which is the source of true innovation. We still have some work to do,” he says.

Cutting costs and time to market with the power of digital technology

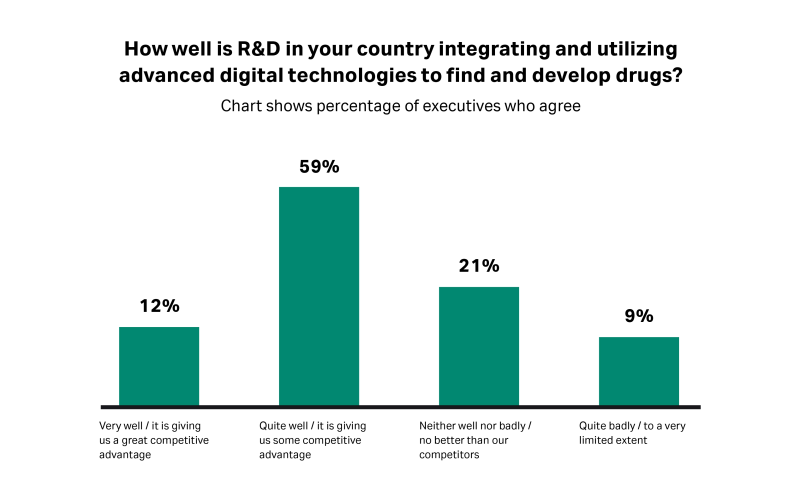

Digital technologies such as artificial intelligence (AI) and advanced analytics have the potential to tackle some of the industry’s productivity challenges, significantly cutting the cost of medical trials and the time required to take new products to market.But our research suggests that many countries are yet to seize the digital R&D opportunity, with only around one in 10 executives reporting that they are using “Pharma 4.0” technologies (a new digital framework for pharmaceutical manufacturing) “very well.”

Respondents in developed markets appear to be faster to adopt digital technologies than those in emerging markets. Industry executives in the US and UK are most likely to say they are making use of digital technologies as part of their R&D efforts (39% and 28%, respectively).

Fig 2. Only one in 10 executives report that their country is using advanced digital technologies “very well” in their R&D activities.

Biopharma leaders are prioritizing their domestic R&D ecosystems

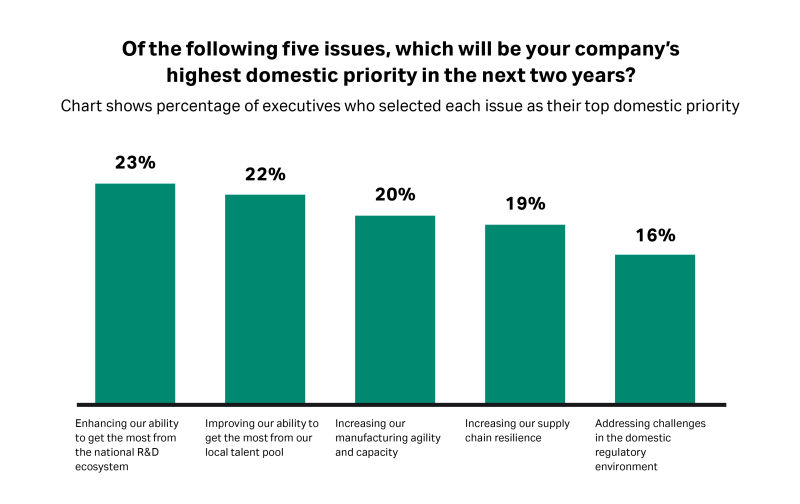

Although it’s the lowest scoring pillar in the index, according to the research, biopharma executives are making the national R&D ecosystem a top domestic priority.

Fig 3. Nearly a quarter of executives say that getting the most from the national R&D ecosystem is a top domestic priority.

Dave Tudor, Managing Director of the Medicines Manufacturing Innovation Centre at CPI, the process manufacturing partner in the UK government's High Value Manufacturing Catapult, believes the UK has the best innovation ecosystem in the world — but warns against complacency. “The government needs to continue to sustain that ecosystem and innovation must be matched by strong fiscal policy in order to remain globally competitive,” Tudor says.

In 2020, net government expenditure on R&D for pharmaceuticals in the UK was £15.3 billion, an increase of £1.7 billion in current prices2 since 2019. However, gross expenditure on R&D as a proportion of GDP still lags behind that of several other countries, with the UK ranking twenty-third out of 44 member countries and selected other economies within the Organisation for Economic Co-operation and Development (OECD).

Raising per-capita pharmaceutical R&D investment in the UK to a level comparable with that of the US would funnel an extra £7.2 billion into the sector each year, according to a 2022 report for the Association of the British Pharmaceutical Industry by PwC.3

“It's important that the innovation ecosystem is sustained by the triple helix of government, industry, and academia funding,” says Tudor. “Don't just invest for two or three years; it’s got to be a 10-year strategy. We need a continued way of innovation funding that really drives what needs to happen to keep the ecosystem hungry and alert to what’s coming through.”

For Aurélia Nguyen, Chief Programme Strategy Officer at Gavi, the Vaccine Alliance, helping the global R&D community to understand the applicability and impact of R&D is key to attracting talent and building R&D capability.

“I think having that level of dialog within the R&D community can make a clearer results chain between the work that we do, the products we develop, and the applications for patients. It has been hugely beneficial for Gavi in terms of making sure that we have access to new vaccines and technologies that increase the reach of our programs. It’s highly motivating to the R&D community to really understand the value of the work that they do,” she enthuses.

R&D talent is the bedrock of global biopharma’s success. What’s more, there is power in collective action. “Different companies, different engineers, and different scientists have their expertise in different areas of the wider ecosystem, so collaboration across the ecosystem will expedite production and make medicines available to patients faster,” says Kyu-Sung-Lee, Global Head of Technical Operations at biotechnology company BeiGene. “We experienced that [during the pandemic] and it can be done again.”

Read the 2023 Global Biopharma Resilience Index to find out how global biopharma can unlock R&D productivity.

References

1 Digital R&D: The Next Fronter for Biopharmaceuticals. McKinsey & Company. 2017. Accessed May/June 2023.

2 Haves E. Research and development spending: Pharmaceuticals. House of Lords Library. September 30, 2022. Accessed May/June 2023.

3 Act now to bring £68bn economic boost to the UK through new research investment. The Association the British Pharmaceutical Industry. June 30, 2022. Accessed May/June 2023.