|

| Courtesy of Biogen Idec |

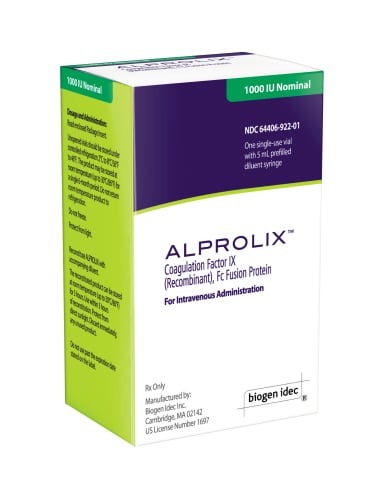

With a pair of long-acting hemophilia meds on the way, Biogen Idec ($BIIB) appears poised to shake up the market for the bleeding disease. And though recently approved Alprolix has yet to launch, it has already made waves: Biogen has priced it on par with older therapies, leaving competitors vulnerable to patient-switching.

The Cambridge, MA-based company has set the price tag on the once-weekly-or-less hemophilia B med, which scored FDA approval last month, to keep its costs about the same as those of Pfizer's ($PFE) twice-weekly competitor Benefix. Given Alprolix's more convenient dosing regimen, rival drugmakers may need to lower their own prices--quickly--if they want to retain their grip on patients.

"In essence, Biogen appears to be more focused on getting the patient switches," ISI Group analyst Mark Schoenebaum wrote in a note to investors about the pricing strategy.

But there may be more to it. Biogen is prepping the novel med for launch at a time when sensitivity to next-generation drug pricing is particularly high, thanks to hep C wonder Sovaldi from Gilead ($GILD). With a sticker price of $84,000 per 12-week course of treatment, the new pill has ignited a firestorm as payers fight to keep it from overwhelming their budgets and, in some cases, decimating their bottom lines.

In an interview with Reuters, Biogen's head of global commercial operations, Tony Kingsley, called Alprolix "a meaningful advance in a market that hasn't seen a significant advance in a decade and a half." But by matching older products on the pricing front, the biotech can avoid stirring up any Gilead-esque pricing commotion while maximizing its top-line potential, according to Leerink Partners analyst Marko Kozul.

|

| Biogen's head of commercial operations Tony Kingsley |

"We believe annual price parity for these emerging products ... along with their innovative safety, efficacy, and dosing benefits is ideal to creating goodwill among the hemophilia community, preventing payer push-back"--and scoring big sales come launch time, Kozul said in an investor note.

But with hemophilia B affecting only about 4,000 people in the U.S., the bigger issue will be where Biogen's hemophilia A candidate--Eloctate, for which it expects FDA approval in the next few months--ultimately falls on the pricing spectrum. Some analysts have said that drug could come to control 37% of the adult market over the next two years, despite a handful of companies--including Baxter and Novo Nordisk ($NVO)--fighting for sales in the much-larger A sphere.

Kozul, for one, wants to see Biogen extend its Alprolix philosophy, a move that could drive prices down on existing therapies. "We hope [Biogen] will pursue a similar pricing strategy for Eloctate should it garner FDA approval near term," he wrote.

- get more from Reuters

Special Report: Top 20 Orphan Drugs by 2018 - NovoSeven