|

| IntelGenx's VersaFilm technology--Courtesy of IntelGenx |

Canadian delivery specialist IntelGenx Technologies ($IGXT) and Israeli partner RedHill Biopharma ($RDHL) suffered the FDA's rejection of their dissolvable migraine film. But the companies say they can turn it around quickly because regulators didn't take issue with the study data--rather, third-party manufacturing practices were to blame.

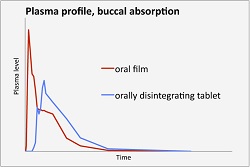

The film, using IntelGenx's VersaFilm delivery tech, is a formulation of Merck's ($MRK) migraine drug Maxalt, which is available in a disintegrating tablet form--the thin film is designed to dissolve faster in the mouth. For patients who have difficulty swallowing other migraine pills due to nausea associated with the disease, the film formulation, which offers a bioequivalent of Maxalt using the active ingredient rizatriptan benzoate, offers a quick-dissolving alternative.

IntelGenx used VersaFilm to deliver other drugs, including ones for depression, erectile dysfunction and neuropathic pain.

The FDA's complete response letter raised questions regarding third-party Chemistry, Manufacturing and Controls, as well as packaging and labeling of the film. The company says that none of the regulators' questions related to product safety and that no additional studies were needed.

|

| VersaFilm's oral absorption vs. a tablet--Courtesy of IntelGenx |

For that reason, the companies are confident that they can turn around and submit the information the FDA needs "within a few weeks."

"We appreciate the thorough review of the product NDA by the FDA," IntelGenx CEO Rajiv Khosla and RedHill CEO Dror Ben-Asher said in a joint statement. "… We believe that the questions raised by the FDA can be addressed based on available data, and we plan to work vigorously to submit our response within a few weeks in order to bring this product to market as a new therapeutic option for the benefit of patients suffering from migraines."

Rizatriptan-based drugs were estimated to exceed $1.6 billion in 2012, the companies said, and Merck's version collected more than $600 million of that.

IntelGenx and RedHill also have European approval in mind, having had a positive meeting with German regulators in October last year. They hope to have approval later this year.

- here's the release