Eisai won speedy FDA approval for its new cancer drug Lenvima, eyeing $1 billion in potential sales and setting the stage for a showdown with Bayer's cancer-fighter Nexavar.

The regulatory OK clears Lenvima for use in patients with the most common form of thyroid cancer, which kills almost 2,000 Americans each year. Lenvima, a tyrosine kinase receptor inhibitor, got a thumbs-up from the agency two months ahead of schedule, an early blessing for Eisai as it looks to compete with Bayer for a piece of the thyroid cancer market.

|

| FiercePharma file photo |

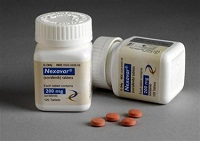

When Bayer's Nexavar nabbed U.S. approval in thyroid cancer in late 2013, analysts predicted the indication could add as much as $200 million in annual sales. So far, Nexavar isn't raking in much new money, though. The drug, which the company shares with Amgen ($AMGN) subsidiary Onyx Pharmaceuticals, generated €577 million for Bayer alone for the first 9 months of 2014, up just slightly from the same period in 2013.

Eisai, by contrast, sees Lenvima bringing in $1 billion by 2020 if everything goes according to plan, vice president Ivan Cheung told The Wall Street Journal last week.

Analysts' numbers place estimates for Lenvima lower, according to Evaluate Pharma data. Worldwide sales for the drug are expected to reach $424 million by 2019, while sales for Nexavar are predicted to ring in at $1.16 billion the same year.

Regulators based their approval for Lenvima on Phase III data released last year, which shows the drug significantly improved progression-free survival in thyroid cancer when compared with placebo. Lenvima patients lived an average of 18.3 months without their condition worsening, as opposed to an average of 3.6 months for patients treated with a placebo. And 65% of Lenvima patients saw their tumors shrink, compared with 2% in the placebo patients.

Lenvima's approval for thyroid cancer is just one piece of a bigger puzzle, as Eisai hopes to expand into other types of cancer. Bayer has been charting a similar course; Nexavar is already approved around the world in kidney and liver cancer, and the company has tested Nexavar in patients with breast cancer. But Nexavar missed its primary endpoint in a Phase III trial last July, failing to delay the progression of advanced breast cancer.

Meanwhile, Eisai is trying to recoup patent losses on some of its top-selling products, including Alzheimer's drug Aricept and acid reflux treatment AcipHex. The company's latest launches, weight-loss drug Belviq and seizure med Fycompa, have also faced their fair share of problems. Eisai ramped up its sales force and expanded its DTC campaign for Belviq last year, looking to swing numbers for the drug northward. In the third quarter of 2014, the company raked in $16.8 million for Belviq and partner Arena Pharmaceuticals ($ARENA) posted $5.2 million in revenues, more than double last year's number.

- here's Eisai's release (PDF)

- read the FDA's statement

- and here's FierceBiotech's take

Special Report: Top 20 orphan drugs by 2018 - Nexavar