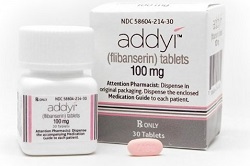

Last month, when outlining dismal sales performances in several of Valeant's ($VRX) key businesses, CEO J. Michael Pearson promised a restructuring. Now, the cuts have begun--and they're starting with the sales force for underperforming female libido pill Addyi.

Valeant has nixed the rep army promoting the closely watched drug after six disappointing months on the market, Bloomberg reports--meaning 140 contract workers will get the axe. The Canadian drugmaker plans to relaunch its sales effort later this year with a team it will assemble internally, according to the news service's sources. And it's also dismissing 140 workers across its dermatology, GI and women's health divisions.

Valeant has nixed the rep army promoting the closely watched drug after six disappointing months on the market, Bloomberg reports--meaning 140 contract workers will get the axe. The Canadian drugmaker plans to relaunch its sales effort later this year with a team it will assemble internally, according to the news service's sources. And it's also dismissing 140 workers across its dermatology, GI and women's health divisions.

"While the former team did a great job getting regulatory approval for Addyi, and despite our best efforts with respect to commercialization, sales of Addyi have not met our expectations yet," Pearson told employees in a memo seen by Bloomberg and Reuters.

Addyi has been in the spotlight since it won FDA approval in August--a move many critics slammed, thanks to the med's questionable efficacy and slate of dangerous side effects. Valeant, then on a buying spree, agreed to pick up maker Sprout the very next day, shelling out $1 billion in cash and milestone payments for the North Carolina company.

As Pearson noted on a disastrous earnings call last month, though, Addyi sales never took off, with some critics blaming the poor showing on Valeant's lofty price tag.

"Valeant predatorily priced Addyi at $800 a month even though Sprout had established a price point of approximately $400 a month for the drug based on market research," an investor group wrote in a letter to Valeant earlier this month. "As a result of this predatory pricing, insurance companies refused to cover the drug, which has led to the drug not being affordable for millions of women."

But embattled Valeant--whose lengthy job-chopping resume dates back to its days as a serial buyer--knows its work won't be done with the Addyi team, and with its other 140 job cuts, its dermatology business--the unit hardest by Valeant's severed relationship with controversial specialty pharmacy Philidor--will take the biggest blow. The reason? Valeant has "received increasing feedback from doctors that we have too many people calling on them to discuss closely related products," the memo said.

Meanwhile, Valeant has plenty of other problems to take care of. It's currently searching for a new CEO to replace Pearson, whom it canned after news that a delay in its regulatory filings could mean defaulting on its debt sent investors running for the doors. Those delays stemmed from a $58 million accounting misstep related to Philidor, which an ad hoc committee uncovered while investigating claims that Valeant used Philidor to inflate its top line.

And then there's the congressional wrath Valeant has sparked in recent months with its price-hike strategy--and refusal to answer some of lawmakers' pointed questions about its business model. Last week, the Senate's Special Committee on Aging revealed that it expected Pearson to testify as a witness at an upcoming hearing--its third on the issue of "sudden, aggressive price spikes of decades-old" prescription drugs.

- get more from Bloomberg

Special Report: The most influential people in biopharma today - J. Michael Pearson - Valeant