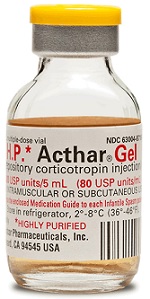

Infamous short-seller Citron Research has another pharma in its sights: Mallinckrodt. The reason? Apparently, its aggressive pricing on H.P. Acthar Gel--and potential payer pushback against those prices.

The firm mentioned Mallinckrodt ($MNK) on Twitter Monday afternoon, saying that the company has "significantly more downside than Valeant" and calling it a "far worse offender" of the reimbursement system.

"[M]ore to follow," Citron promised in the tweet. Mallinckrodt shares dropped 17%, its biggest decline since it was spun off from Covidien in 2013, Bloomberg points out.

Acthar prices have been under fire for years, long before Mallinckrodt took over its previous maker, Questcor ($QCOR). Per-vial prices rose from $1,500, when Questcor bought it, to $28,000 in 2013. That higher price landed it on FiercePharma's most expensive drugs list, with a $205,000-plus annual list cost.

Along the way, Questcor bought the rights to a potential head-to-head competitor, Synacthen Depot, from Novartis ($NVS), to lock down the competition. It also belatedly disclosed thousands of side effect reports to the Securities and Exchange Commission, after a New York Times story linked Acthar to 20 deaths and half a dozen disabilities. Meanwhile, the higher prices pushed up Medicare's spending on the drug, approved to treat a laundry list of inflammatory diseases, leading some medical experts to take issue with its high prices.

Along the way, Questcor bought the rights to a potential head-to-head competitor, Synacthen Depot, from Novartis ($NVS), to lock down the competition. It also belatedly disclosed thousands of side effect reports to the Securities and Exchange Commission, after a New York Times story linked Acthar to 20 deaths and half a dozen disabilities. Meanwhile, the higher prices pushed up Medicare's spending on the drug, approved to treat a laundry list of inflammatory diseases, leading some medical experts to take issue with its high prices.

Citron Research zeroed in on Valeant ($VRX) a couple of weeks ago, with a report likening the Quebec-based drugmaker to Enron, and accusing it of using a network of pharmacies to gin up "phantom sales."

"The market has been so focused on Valeant that they forgot about other platform companies who are levered and face the same headwinds in reimbursement," Citron Research chief Andrew Left said in an emailed statement. "We already see these challenges at Mallinckrodt and while Valeant has been taking all the heat, the business model of Mallinckrodt is just as, if not more, in danger of unraveling."

|

| Mallinckrodt CEO Mark Trudeau |

Company CEO Mark Trudeau told CNBC Tuesday that he doesn't expect to see reimbursement challenges on Acthar's price. The company has invested heavily in studying Acthar for a variety of new indications, Trudeau says. Alternative treatments are even more costly, he contended. Mallinckrodt has said it doesn't own or have a stake in any specialty pharmacies, Bloomberg reports.

But Mallinckrodt definitely faces investigations by federal and state authorities. The Federal Trade Commission demanded documents and information about Questcor's 2013 deal for the rights to potential rival Synacthen Depot. "[A] small number of states" are also looking into whether the deal violates state antitrust laws, Mallinckrodt disclosed earlier this year.

- see the Bloomberg story

- get more from CNBC

Special Report: The top 10 most expensive drugs of 2013 - H.P. Acthar Gel