On a busy morning after Bristol Myers Squibb revealed that the FDA approved its potential blockbuster Camzyos, the pharma giant also introduced negative news about a fading blockbuster.

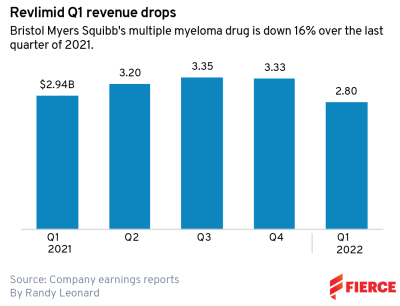

Sales of cancer powerhouse Revlimid—now challenged by generic competition—came in below expectations at $2.8 billion in the first quarter, compared with $2.9 billion a year ago.

The performance prompted BMS to slice its 2022 revenue projection for the multiple myeloma drug by $500 million. In addition, BMS now expects its overall 2022 sales to be "in line" with last year's revenues of $46.4 billion. Previously, the company had guided for 2022 sales of $47 billion.

In response to the news, the company’s shares were down 4% by mid-morning.

The Revlimid shortfall stemmed from sales outside the U.S., which dropped by 23%, from $986 million to $759 million. “Internationally, generics launched broadly across Europe in mid-February and erosion has been faster than expected,” David Elkins, BMS’s chief financial officer, said during a conference call.

While generics to Revlimid entered the U.S. market later in the quarter than expected and “so far at a modest pace,” Elkins said, that will change in the second quarter.

“We expect variability quarter to quarter due to the uncertainty of how generic players will enter the market,” Elkins added. “Though there is no change to our outlook for the U.S. with Revlimid this year and beyond, we expect the favorability we saw in Q1 to reverse in Q2.”

Previously, BMS expected $9.5 billion to $10 billion in 2022 sales for the drug. It's now trimmed the figure to $9 billion to $9.5 billion.

Further, BMS expects sales of Revlimid to come in at $2 billion overall in the second quarter, which could make reaching the low end of the company’s annual projection problematic.

To approach the $9 billion figure, Revlimid would have to match that $2 billion performance in the third and fourth quarters, a difficult feat considering Elkins’ warning of “more generics in the U.S. in the second half of the year.”

For the first quarter overall, BMS reported revenue of $11.6 billion, a modest increase of 5% from the same period from last year, driven by sales of its mainstay products.

Blood thinner Eliquis reached $3.2 billion, up 12% from a year ago, while cancer drug Opdivo also posted double-digit growth from $1.7 billion last year to $1.9 billion.

Melanoma drug Yervoy was up 13% to $515 million, while new anemia treatment Reblozyl pulled in $156 million, for an increase of 39% year over year.

While BMS is suffering from Revlimid generics, the company has a plan to replace the revenue. Camzyos is one new med expected to bring in blockbuster-level sales, along with Reblozyl and plaque psoriasis prospect deucravacitinib.