Amid guidance tweaks, manufacturing pledges and corporate resets, AstraZeneca’s formal withdrawal of its U.S. COVID-19 vaccine application last week may best capture the sense of change running through 2022’s third quarter. Biopharma, like the rest of the world, is in flux. And, while the industry’s top players largely held their own for the first half of the year, drugmakers are increasingly switching up their tactics to cope with a host of market pressures.

Those continue to include inflation, supply chain chokeholds and the war in Ukraine. Elsewhere, the clock is ticking down on exclusivity for chief members of the pharmaceutical pantheon such as AbbVie’s Humira and Merck & Co.’s Keytruda.

But perhaps the most common thread this earnings season was the now undeniable decline of the COVID-19 vaccine market.

Pandemic push and pull

Speaking on a conference call last week, AstraZeneca CEO Pascal Soriot told investors the company was throwing in the towel on its COVID shot Vaxzevria in the U.S. The helmsman argued the U.S. market is already saturated with mRNA vaccines from Pfizer-BioNTech and Moderna.

Outside the U.S., where Vaxzevria posted no sales for the quarter, the vaccine’s global revenue plunged 83% to $173 million.

And AstraZeneca’s not alone.

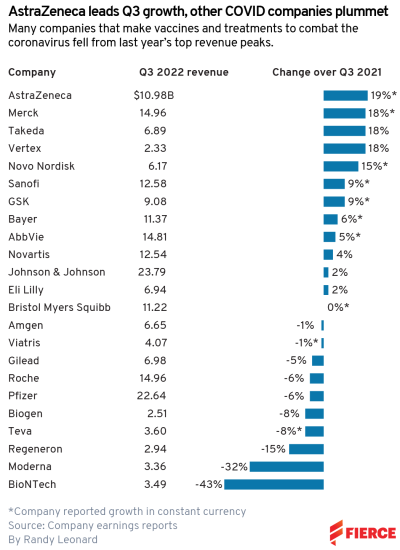

Moderna's third-quarter sales fell 32% to $3.36 billion, while BioNTech's haul cratered 43% to $3.49 billion.

Pfizer, for its part, posted better than expected Comirnaty sales in the quarter, but it still saw overall sales slip by 6%.

Going forward, Lee Brown, global sector lead for healthcare at Third Bridge Group, said he expects some commercial troubles for the mRNA vaccine superstars.

“Pfizer, BioNTech and Moderna will struggle with the transition to the post pandemic environment simply due to challenging year-over-year comps as the COVID-19 related revenue and earnings meaningfully decline over the next few years and present significant headwinds to growth,” Brown said.

Brown suggested the pandemic market opportunity is “waning,” which has placed Moderna’s late-stage pipeline under “increasing pressure to deliver.”

Among its many mRNA projects, Moderna is working on vaccines for seasonal flu, respiratory syncytial virus and cytomegalovirus, to name a few.

Number crunch

While AstraZeneca was dealt a blow this quarter on the COVID-19 front, the company performed well overall, buoyed by its “powerful portfolio” of Tagrisso, Imfinzi, Lynparza, Calquence and Farxiga, Brown said. And while AZ may not have topped the sales charts in the third quarter, the company did surpass all its Big Pharma peers when it came to revenue growth versus the same period last year. During the third quarter, the company grew sales 19% to $10.98 billion, trailed closely by Merck, Takeda and Vertex, which each posted gains of 18%.

In terms of raw sales figures, Johnson & Johnson and Pfizer unsurprisingly swept the competition with total revenue of $23.79 billion and $22.64 billion, respectively. In J&J’s case—and amid the company’s quest to hit $60 billion in pharma sales by 2025—that sum represents a slim 2% increase over the third quarter of 2021.

On the flip side, Biogen reported some $2.5 billion in sales for the third quarter, down 8% at constant currencies. That put the Big Biotech below the likes of Teva, Regeneron, Moderna and BioNTech in overall sales. Biogen has spent the year trying to rebound from the ill-fated launch of its Alzheimer's disease med Aduhelm.

With upcoming prospects in Alzheimer’s, amyotrophic lateral sclerosis and depression, Biogen aims to pivot into “renewed growth” with “5 key franchises” by 2025, the company’s outgoing CEO, Michel Vounatsos, told investors this month.

For Regeneron, Moderna and BioNTech, solid sales showings in the third quarter simply couldn't compare to the pandemic peaks they enjoyed in 2021.

Regeneron, for example, recorded just $6.4 million in sales of its COVID antibody Ronapreve, versus about $127 million in the third quarter of 2021. And while BioNTech handily beat analyst expectations with Comirnaty revenues of 3.5 billion euros, that wasn't enough enough to stack up against 2021's performance.

Manufactured future

Manufacturing marked another cross-company refrain this earnings season. For some companies, like German conglomerate Bayer, the focus was on shoring up supply chain stability and locking down raw materials to thwart bottlenecks. For others, like Biogen, Eli Lilly and Novo Nordisk, the production buzz revolved around ensuring steady stocks of new and upcoming meds.

Biogen, for instance, scrapped most of the commercial infrastructure for its fallen Alzheimer’s disease drug Aduhelm earlier this year, but the company has managed to salvage its manufacturing firepower as it awaits a January FDA verdict on its next neural contender lecanemab, which it’s working on with Eisai.

Should the antibody win approval next year, Biogen already has facilities on deck to crank out the drug, plus “a little over $100 million of inventory on hand as of the end of the quarter,” Biogen’s chief financial officer Michael McDonnell said on a recent investor call.

Meanwhile, Eli Lilly and Novo Nordisk, duking it out in diabetes and eyeing a potential showdown in obesity, are both looking to boost production of their respective incretin meds tirzepatide and semaglutide.

In Type 2 diabetes, Novo’s Ozempic and Lilly’s Mounjaro have experienced skyrocketing demand this year. That has led, in part, to a present shortage of Ozempic, which Novo is attempting to rectify by “gradually increasing [its] supply capacity,” the company’s chief financial official Karsten Munk Knudsen told analysts in early November.

Novo’s supply squeeze has been a boon to demand for Lilly’s GIP/GLP-1 newcomer Mounjaro and its diabetes stalwart Trulicity. At the same time, however, the drugs’ popularity challenged Lilly’s “ability to meet expanding demand [for Trulicity] in most international markets,” the company’s CFO Anat Ashkenazi admitted on a recent conference call.

As Third Bridge’s Brown sees it, Eli Lilly will continue to soar so long as it keeps hitching its wagon to Trulicity’s star.

Straddling the patent cliff

Another leitmotif in the third quarter was the high-profile losses of exclusivity facing the industry's top players, Third Bridge’s Brown pointed out. Bristol Myers’ multiple myeloma drug Revlimid took an especially brutal hit as international sales plummeted 76% to $250 million, down from $1 billion in the prior-year period, Brown noted. The analyst pointed to other generic casualties like Lilly’s cancer med Alimta, Roche’s eye drug Lucentis, AbbVie’s Restasis and Takeda’s oncology therapy Velcade.

Meanwhile, AbbVie and Merck are hard at work drafting contingency plans ahead of their respective blockbusters’ plunges off the patent cliff. For AbbVie and Humira, the company is trumpeting immunology successors Rinvoq and Skyrizi, a duo pegged to deliver some $7.5 billion in combined sales this year. With that performance in mind, AbbVie now has a “high degree of confidence” in the pair's potential to “ultimately exceed the peak revenues achieved by Humira,” AbbVie CEO Rick Gonzalez recently told investors.

As for Merck and its cancer superstar Keytruda, which is expected to lose its patent protection in 2028, the company’s cardiovascular pipeline could help blunt the exclusivity hit, CEO Rob Davis said in October. “By the 2024-28 time frame we could have as many as eight new approvals driving revenue that could be in excess of $10 billion by the mid-2030s,” he said.

Currency tolls

Lastly, another big factor this past quarter was currency changes. European companies with a big U.S. business that report in local currencies, such as Novo Nordisk, GSK and Sanofi, saw a tailwind from the strong dollar over the three-month stretch. Currency moves were a prominent topic on third-quarter earnings calls and helped fuel the current volatility in the industry.