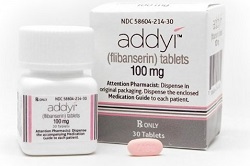

When Valeant Pharmaceuticals ($VRX) made its deal to buy the female libido pill maker Sprout, it agreed to pay $1 billion in cash and promised a share of future profits. Now that Sprout's Addyi pill is falling short of early sales expectations, Sprout's investors are worried about lower-than-expected royalties--and they're blaming Valeant for the shortfall.

Specifically, they're blaming Valeant's pricing on the drug, adding their voice to a chorus of critics who question the company's price-tag policies, Bloomberg reports.

Specifically, they're blaming Valeant's pricing on the drug, adding their voice to a chorus of critics who question the company's price-tag policies, Bloomberg reports.

"Valeant predatorily priced Addyi at $800 a month even though Sprout had established a price point of approximately $400 a month for the drug based on market research," the investor group said in a recent letter to Valeant (as quoted by the news service). "As a result of this predatory pricing, insurance companies refused to cover the drug, which has led to the drug not being affordable for millions of women."

As Bloomberg reports, Sprout investors wrote Valeant on March 14 to challenge the company's Addyi marketing. Valeant's commercial wing faltered on Addyi's launch, the investors say. And they want proof that Valeant will follow through on its promise to spend $200 million on Addyi marketing and R&D from January of this year through the first half of 2017. When the FDA approved Addyi last year, the agency slapped a black-box warning on the med and required follow-up studies on its safety.

They also want Valeant to confirm that it will keep 150 sales reps on Addyi despite lackluster sales since its launch.

Valeant says it can't comment on the specifics of its Sprout agreement but promises to follow through on its commitments. "Valeant intends to comply with all of its obligations under our agreement with the former shareholders of Sprout, including as they relate to marketing spend, number of sales reps, and post-marketing studies," spokeswoman Laurie Little said in a statement.

In its disastrous earnings release earlier this month, Valeant CEO J. Michael Pearson tagged Sprout as one of four underperforming businesses. Pearson had predicted up to $150 million in sales from launch through mid-year 2017 late last year. But when Valeant reported its other numbers March 15, Pearson admitted that forecast would have to be cut "significantly."

Valeant says it's still committed to Addyi, and its reps are beating the street to educate providers about the drug. Meanwhile, Sprout has cut some jobs and let go two of its national sales directors, Bloomberg says, quoting sources. Part of the problem is that Valeant had counted on its specialty pharmacy, Philidor, to distribute the drug and deal with reimbursement, but Valeant cut ties with Philidor after allegations of misconduct and channel stuffing cropped up last year.

The $200 million investors quoted for marketing and R&D spend on Addyi is supposed to cover DTC marketing, disease awareness campaigns, promotional materials and more. But the FDA's approval prohibited any DTC advertising on Addyi for 18 months after its August 2015 launch.

- read the Bloomberg story