In the hopes of catching up with AstraZeneca and GSK, Clovis Oncology recently trotted out a broad trial success that supported bumping up Rubraca in the ovarian cancer treatment order.

But when the FDA asked for more data, concerns started to grow that the agency had seen some worrying signs in the trial data that weren’t made public.

Now, with a full-on presentation at the 2022 American Society of Clinical Oncology annual meeting, Clovis CEO Patrick Mahaffy hopes to clear the air. Refuting the FDA, he argues that existing data should be enough to support an application for Rubraca in patients with newly diagnosed ovarian cancer after an initial round of chemotherapy.

“There is absolutely nothing—nothing at all” that people should be concerned about in Rubraca’s ATHENA-MONO phase 3 data, Mahaffy said in an interview with Fierce Pharma.

That doesn't mean the FDA will agree. But Mahaffy aims to make his case.

Rubraca shows benefits across patient groups

As Clovis previously announced, under an investigator analysis, Rubraca slashed the risk of disease progression or death by 48% over placebo in all patients regardless of tumor biomarker status in front-line maintenance treatment of ovarian cancer. By assessment of a blinded independent review panel, the risk reduction was 53%.

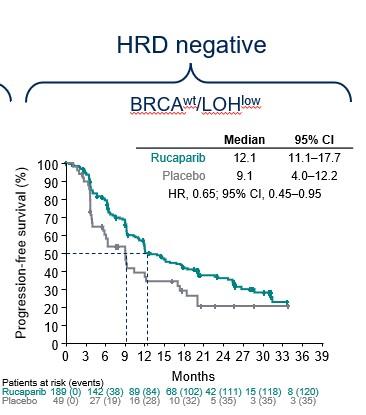

PARP inhibitors like Rubraca typically work better in BRCA-mutated cancer or, more broadly, tumors with homologous recombination deficiency (HRD). But Rubraca also showed a benefit in HRD-negative patients, paring down the risk of progression or death by 35% under investigator analysis or by 40% according to the independent review.

The numbers look on par with—or even better than—those GSK’s Zejula posted in its own first-line maintenance study. In the phase 3 PRIMA trial, Zejula reduced the risk of disease progression or death by 38% in the overall population and 32% in HRD-negative patients. AstraZeneca and Merck’s leading PARP inhibitor, Lynparza, isn’t allowed in HRD-negative patients, who represent about half of the entire ovarian cancer population.

in the Athena-Mono trial (Bradley Monk, et al/ASCO 2022)

The progression-free survival curves between Rubraca and placebo remain separated in ATHENA-MONO, indicating an ongoing advantage for the Clovis drug. But by investigator analysis, the curves appear to be nearing a crossing among patients with HRD-negative tumors.

Mahaffy played down the trend observed in the subgroup analysis, arguing it’s not statistically powered and that the investigators don’t find it worrisome, either.

FDA concerned but by another study

Then what’s causing the additional FDA scrutiny? A renewed FDA focus on patient survival. According to Mahaffy, the agency is “looking to ensure that there is no decrement.”

The concern stemmed from the ARIEL4 trial. As a postmarketing study of Rubraca’s third-line BRCA-mutated ovarian cancer indication, ARIEL4 showed that in patients who had already received two or more lines of chemo, the Rubraca takers' lives were shorter than the chemo group's. The Clovis drug was linked to a 31.3% increased risk of death, the study showed.

But Mahaffy noted it was the platinum-resistant subgroup, with their 51.1% increased risk, that pulled Rubraca back. The drug’s data in platinum-sensitive patients were the same as Lynparza’s in a separate platinum-sensitive-only trial dubbed SOLO3. Plus, ARIEL4’s overall survival analysis was “highly confounded by subsequent therapy,” Mahaffy said.

Still, in a recent securities filing, Clovis said the FDA has reviewed the ARIEL4 data, which may lead to the company withdrawing Rubraca’s third-line ovarian cancer indication in the U.S. and possibly in Europe as well.

For now, the ATHENA-MONO trial has yet to show a clear overall survival signal, as the risks of death were roughly the same between Rubraca and placebo. The data remain immature as only 25% of the deaths needed to calculated overall survival had occurred.

Previously, Zejula got its front-line maintenance nod for all patients regardless of biomarker status, despite the fact that only 11% of the required number of deaths had happened. At that time, investigators in Zejula’s PRIMA trial provided an estimated two-year survival rate, predicting that 84% of patients on the GSK drug would still be alive by that time point, versus 77% for placebo. Clovis currently doesn’t have those two-year estimates for Rubraca.

Clovis 'actively preparing' for FDA application

Seemingly spooked by the ARIEL4 data, the FDA is asking Clovis to run another ATHENA-MONO overall survival analysis at 50% death events before applying for approval. But as Clovis has noted, it’ll likely take another two years to collect those data.

Mahaffy argued that the current analysis, without any sign of harm to patient survival, should be able to support a filing. “If these data were to have been first disclosed two years ago, they would be equally compelling,” he said.

He pointed to a 2017 white paper on ovarian cancer clinical trial endpoints co-authored by FDA oncology chief Richard Pazdur, M.D. It stated that “the FDA posited that endpoints other than overall survival … could be acceptable for regulatory decision.”

Clovis now hopes to schedule another meeting with the FDA “in the next coming weeks,” Mahaffy told Fierce Pharma. “We want an opportunity for a more fulfilling discussion than we’ve had today.”

The company is “actively preparing” for both EU and U.S. submissions, the CEO said. The FDA has threatened to hold an advisory committee meeting to review the data should Clovis file with the existing information. But Mahaffy sees it as a door cracked open for a potential filing.

And Clovis needs to hurry. Without the large front-line maintenance ovarian cancer setting—which Mahaffy said is at least twofold larger than a second-line maintenance use—Rubraca sales have been declining. Clovis has publicly stated that it needs to raise additional capital, and Mahaffy said there’s an opportunity to potentially partner Rubraca up regionally.