Adding to its healthcare heft, WPP Group bought CMI, a healthcare media agency that counts 10 of the largest 20 pharma advertisers among its clients.

|

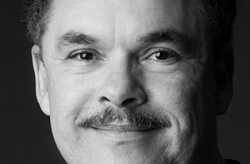

| CMI CEO Stan Woodland |

CMI will not be absorbed into the group, but rather work across WPP healthcare agencies, which include Ogilvy CommonHealth, Sudler & Hennessey and Greyhealth Group. CMI will subsume Ogilvy CommonHealth's medical media unit and be housed under WPP's healthcare parent hub GroupH. It will also work closely with WPP media holding company GroupM.

In fact, CMI has already co-pitched two clients with GroupM, and together they won both assignments, said Stan Woodland, CEO at CMI. WPP has owned a minority stake in Compas, the healthcare media buying company Woodland also presides over, since 2004.

John Zweig, chairman of healthcare and specialist communications at WPP, said his group was impressed with the differentiation CMI has in the market, adding he hasn't previously seen the "depth, sophistication and quality of targeting that CMI does."

"When we combine it with the capabilities in Ogilvy CommonHealth, it's an industry leading offer. Client relationships demonstrate that, both in longevity and in what they feed back as indispensability. When's the last time you heard clients themselves describe an agency resource as indispensable?" Zweig said.

Consolidation in the agency world is nothing new, but it's newer in healthcare specialty agencies. However, more overall agency mergers--and big healthcare M&A--have resulted in larger relationships between the two sides, geographically and in a range of disciplines, Zweig said, which requires a correlating range of skill sets.

Adding to the mergers is the healthcare focus shift to patients, who are also consumers. That's where WPP's global consumer strengths can bolster CMI's healthcare provider expertise, Woodland said. CMI itself has proven its ability to collaborate with both small and large agencies, he said, and the deal expands its reach across the WPP agencies and clients it doesn't already serve.

Zweig said, "What beyond the pill really means is you now have to surround the patient with value-creating information and services that are tailored to that patient. That's where I think the combination of media targeting can not only improve the message, but in the healthcare business, should be able to improve the quality of the therapy because information is part of it," he said.

Terms of the deal were not disclosed. WPP is the largest global marketing communications holding company, with billings of $73 billion and revenue of $19 billion. CMI reported unaudited revenues of $38 million as of the end of 2015 and employs more than 210 people. CMI clients include Amgen ($AMGN), Bayer, Biogen ($BIIB), Eli Lilly ($LLY), Johnson & Johnson ($JNJ) and Novartis ($NVS).

- read the press release