Amid escalating tension between drugmakers and India's National Pharmaceutical Pricing Authority over price caps on "essential drugs," the NPPA has extended its pricing policies to cover 52 additional meds, including commonly used painkillers and antibiotics and drugs for cancer and skin disease treatment.

As The Economic Times reports, more than 450 drug formulations are now on the NPPA's price cap list, and industry experts say big-name drugmakers such as Lupin, Cadila and Merck ($MRK) are likely to be impacted by the government's latest price-control decision. The move follows on the heels of more pricing action from the NPPA, as in September it capped the prices of 43 drugs including the antibiotic Ciprofloxacin and diabetic med Metformin.

The NPPA's latest price-cap decision adds fuel to the fire in its ongoing battle with drugmakers, as pharma companies continue to push back against its restrictive pricing policies. In July 2013, Novartis ($NVS), GlaxoSmithKline ($GSK) and Cipla took complaints to India's courts after the NPPA added 348 meds to its list of essential drugs and placed price caps on them. The drugmakers claimed the NPPA only gave companies 45 days to reprice and restock shelves, a potential boon to business.

But the NPPA was not deterred by the litigation and in spring 2014 established guidelines giving it the power to set prices on drugs that were not on the national list of essential medicines. In July, the pricing authority added three dozen drugs to its essential medicines list and set price caps on about 110 drugs. Some companies such as Novartis struck back, challenging the NPPA's authority to wage new pricing restrictions. In October, the NPPA fined the drugmaker about $49 million for overpricing its popular pain drug Voveran, and Novartis said it would challenge the move in India's High Court.

Meanwhile, drugmakers are seeing more immediate effects from the NPPA's pricing decisions. Sanofi's ($SNY) Indian unit saw its shares fall 10% on the Bombay stock exchange in July in light of the NPPA's new pricing caps, and an earlier report predicted that the total value of the companies' heart and diabetes drugs sold in India could take as much as a 12% hit. To add insult to injury, the company could also see its India sales drop by 9.5% and its profits decrease by 30%, analysts said at the time.

|

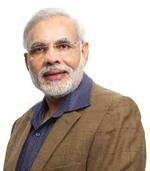

| Narendra Modi |

Still, there could be some light at the end of the tunnel for Big Pharma as India Prime Minister Narendra Modi takes a less restrictive approach to the industry. In September, the NPPA announced that it lost the authority to unilaterally add drugs to its price-cap list. No explanation was given at the time, but an NPPA official who declined to be named said the government's decision affects pricing moving forward--not past regulation.

"The basis to proceed further has been withdrawn," the NPPA official told Reuters at the time. "We are not saying anything on the past. The government always has an overriding power."

- read the Economic Times story

- get more from Reuters

- here's the NPPA's list of new price caps

Special Report: Top 10 Drugmakers in Emerging Markets