By Cytiva

Biological breakthroughs coupled with advances in digital tools, such as artificial intelligence (AI), are setting the stage for a bright future in biopharma. With the industry now projected to reach a value of nearly $1 trillion in 20301, drug developers face the challenge of finding and keeping the talent needed to sustain such rapid growth amid fierce competition.

For the talent pool pillar of our 2023 biopharma resilience research, Cytiva assessed how easily the biopharma industry across 22 countries can access the talent it needs to thrive. The index is based on data from a survey of 1250 pharma and biopharma executives. The overall index score for each country indicates the strength of its biopharma industry.

This year, in addition to the survey data, Cytiva has incorporated external data into the index (on drug-approval timeframes and R&D activity, for example) to give a more accurate overview of the industry in 2023.

Our analysis considers how effectively academic institutions can deliver a strong pipeline of biopharma talent, and how accommodating labor regulations are in terms of allowing biopharma firms to access overseas talent.

Despite major successes across the biopharma industry in recent years, talent challenges are growing

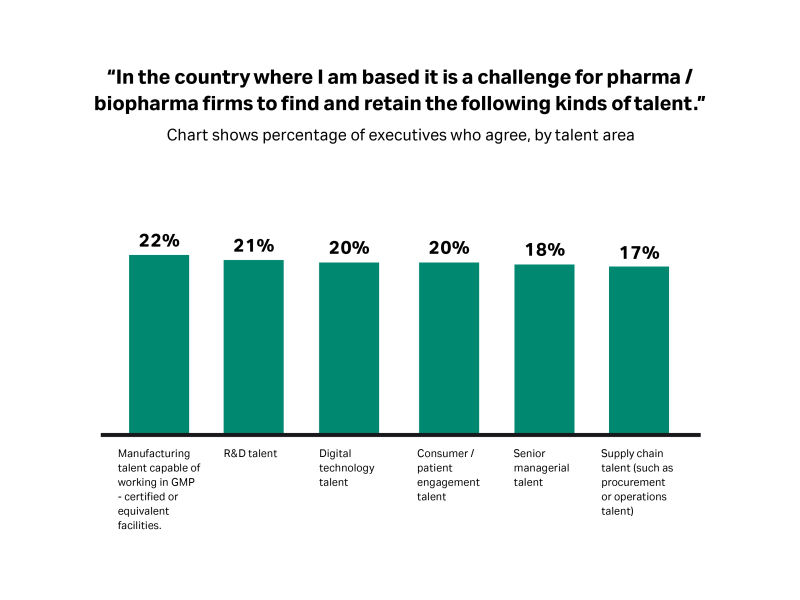

Our research indicates a drop in overall talent pool resilience, with the score falling from 6.27 in 2021 to 5.60 in 2023. Of the five pillars included in our study, this one showed the steepest decline and is the second lowest scoring pillar overall in the 2023 index. This change corresponds to the industry’s current recruitment difficulties: around two in 10 respondents report that it is a “substantial challenge” to find most types of talent within their country, with manufacturing talent being most scarce.

“The demand for talent can be seen across the board, at the very early stages, with scientists, and, further along, with manufacturing engineers. It is something we have to acknowledge,” agrees Wenjie Zhang, Chairman, Executive Director and CEO of Henlius, a global biopharma company headquartered in China. Talent, Zhang suggests, is “always the most important factor for success.”

Fig 1. Biopharma executives are most likely to report that it is a challenge to source GMP*-certified manufacturing talent.

*Good manufacturing practice.

Emerging markets are more greatly affected by talent shortages than mature-market counterparts

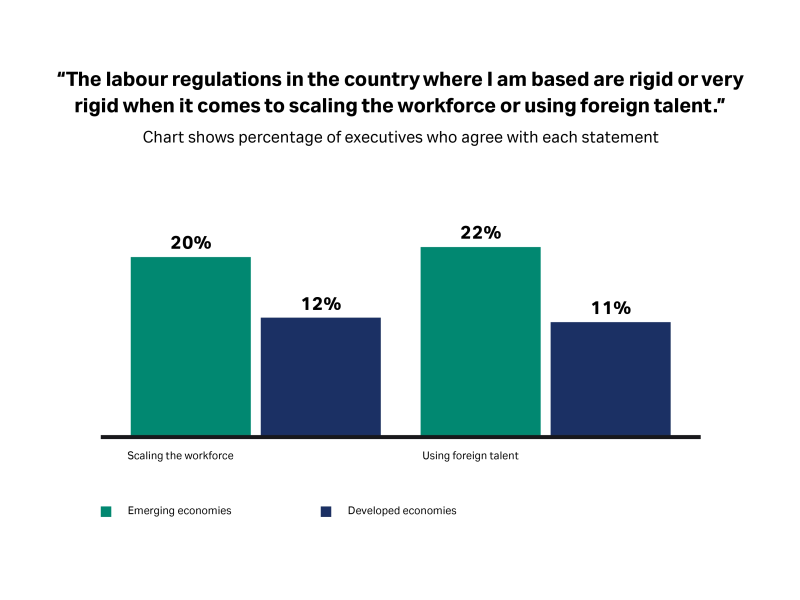

The 2023 index data suggests that emerging markets are struggling much more than their mature-market counterparts to produce and source the talent their biopharma industries need. They are also far more likely to report that labor regulations around scaling the workforce and foreign talent are rigid or very rigid. At the country level, Thailand, UAE, and Saudi Arabia struggle most in this regard, with around 30% of executives agreeing that such regulations are rigid, versus 15% of executives globally.

But the global picture is not entirely bleak. According to Kyu-Sung Lee, Global Head of Technical Operations at biotech company BeiGene, China’s talent pool is growing as more people undergo Western training at an earlier stage of their educational journeys. “Twenty years ago, everybody studied in the US after graduating from college. Now, a lot of young people are coming to the [United] States [and other countries] when they are in high school.”

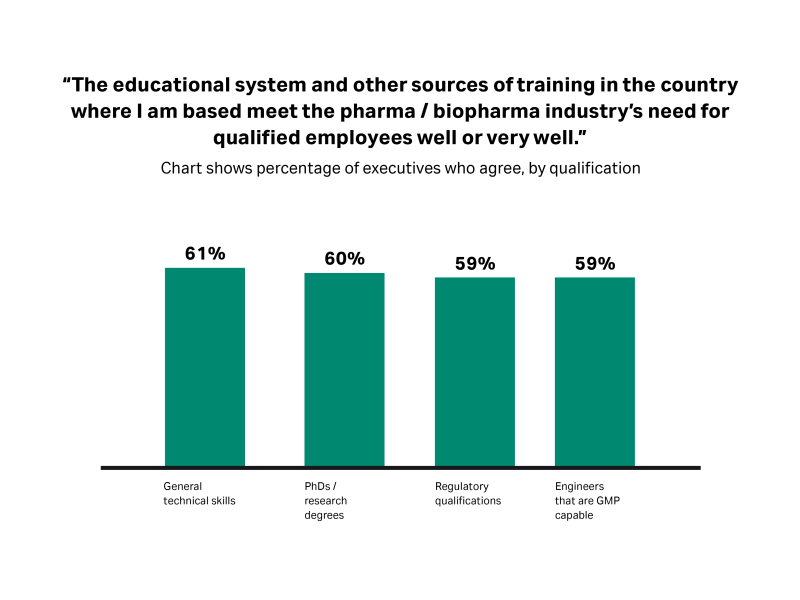

High-quality educational institutions and training beget highly skilled talent. Nevertheless, respondents are markedly less positive about the ability of their domestic education system to produce strong doctoral graduates in 2023 than they were two years ago (60% of respondents in 2023 say the education system does this well or very well, vs 74% in 2021).

To what extent do you agree with the following statement?

Fig 2. Biopharma executives in emerging economies are more likely than those in developed economies to say their country’s labor regulations lack flexibility.

Training and education are key to filling knowledge and skills gaps

Killian O’Driscoll, Chief Commercial Officer of the National Institute for Bioprocessing Research and Training (NIBRT), suggests that there is an expectation that organizations such as his will bridge the gap between higher education and the specialist training required by industry.

“The universities and the community colleges do a fine job of training people in the core principles of genetic engineering, bioprocessing, and chemical engineering and related areas,” O’Driscoll expands. “But it's a challenge for them to provide the very specific training that is required for biopharma manufacturing. And some would argue that it's not the role of a university to provide such a niche focus.”

Leszek Lisowski, a molecular biologist specializing in developing and optimizing viral vector technologies at the University of Sydney Children’s Medical Research Institute, says the draw of higher salaries in the commercial space risks draining talent — and as a consequence, innovation — from academia. “Academia keeps training new people and [subsequently] losing them to commercial, where there's more money, which actually undermines the whole pyramid because most of the developments still come from academia,” he says. “We can never compete with the commercial sector when it comes to salaries and career opportunities – and as long as we keep losing people, that backfires and slows down the overall progress.”

Rather than chasing external hires for specialist roles, more organizations are plugging the skills gap by developing existing talent through digital upskilling. For example, in 2022 Moderna, in partnership with Carnegie Mellon University, launched its AI Academy2 for its 2400 employees to help embed AI across all levels of the company.

Anne-Cécile Potmans, General Manager of Fast Trak™ services, including education and training at Cytiva, oversees an educational program for the company’s scientists to expand their knowledge of process development and manufacturing. “Providing a robust and dedicated training program and curriculum helps to strengthen workforce resilience from a variety of perspectives,” she explains. “The most tangible benefit is that it ensures employees have up-to-date skills in the most advanced areas of biopharma manufacturing. Providing a clear path to development can also help organizations to retain talent. This is particularly important when the industry is growing and the talent supply is limited, or when competition for talent is fierce.”

To what extent do you agree with the following statement?

Fig 3. Less than two-thirds of executives surveyed say the education system in their country meets the biopharma industry’s need for qualified talent across a number of areas.

Government initiatives and collaboration can help meet the industry’s talent needs

Governments are also attempting to improve retention through more competitive salary packages and working conditions. In recent decades, China has used a series of talent-recruitment policies, such as its “Young Thousand Talents” program, to help halt the country’s brain drain3.

Harnessing the right combination of skills is vital for biotech firms with global aspirations. And according to Wenjie Zhang, that means not just technical knowhow, but also leadership skills appropriate to managing a global organization.

Building up a technical skillset in the life sciences also means continuously learning as the science rapidly evolves. “We need to have one eye on the future. Do we have enough data scientists for AI and advanced digital solutions, for example?” asks Dave Tudor, Managing Director of the Medicines Manufacturing Innovation Centre, Quality and Biologics – a collaboration between CPI, University of Strathclyde, UK Research and Innovation (UKRI), Scottish Enterprise, and founding industry partners, AstraZeneca and GSK.

Tudor comments, “We also need to make sure our scientific curriculum is modified to bring in oligonucleotides and ribonucleic acid, the advanced drug modalities that are coming through. We need to keep up with all the latest developments.”

A systemic issue such as biopharma’s talent crisis requires a systemic solution, and countries such as the UK have already reaped the benefits of part-government-funded initiatives such as Knowledge Transfer Partnerships which encourage the sharing of talent, resources, and research facilities between organizations and universities.

A similarly collaborative approach between governments, industry, and academia more widely, as well as greater flexibility in labor regulations, will help ensure that talent pipelines are robust, diverse, and sustainable — an imperative for the future resilience of the industry.Read the 2023 Global Biopharma Resilience Index for more insights into talent pool resilience and other areas the biopharma industry must focus on to safeguard its future.

References

1 Mikulic M. Biopharmaceuticals market size worldwide forecast 2020-2023. Statista. May 24, 2022. Accessed May/June 2023.

2 Johnson D. Moderna Launches AI Academy for All Employees. Moderna. December 09, 2021. Accessed May/June 2023.

3 Marini G. Yang L. Globally Bred Chinese Talents Returning Home: An Analysis of a Reverse Brain-Drain Flagship Policy. Oxford Academic. June 01, 2021. Accessed May/June 2023.