Besides Pfizer’s fast-declining COVID-19 sales, vaccine rival GSK is giving the New York drugmaker another reason to worry.

In the first round of their RSV vaccine showdown, GSK’s Arexvy pulled down 709 million pounds ($860 million) in the third quarter, more than doubling the $375 million haul from Pfizer’s Abrysvo during the same period.

In what GSK CEO Emma Walmsley called an “outstanding U.S. launch,” Arexvy sales came in nearly 100% above Wall Street analysts’ expectations.

“The key point here for GSK is this pivot to the prevention agenda, which is just better for everybody—burdened healthcare systems, budgets, patients [and general practitioners],” GSK CEO Emma Walmsley said Wednesday during a press call.

After approvals earlier this year, both vaccines are being launched into their first RSV season. The FDA cleared the two shots to prevent RSV in individuals 60 years of age and older in May, with GSK 28 days ahead of Pfizer.

At retail sites, which comprise the majority of the older-adult RSV market, Arexvy is getting two-thirds of the share in the U.S., Walmsley said.

For Arexvy’s launch, GSK chose to highlight the vaccine’s 94.6% efficacy in older adults with some underlying medical conditions, a message that “seems to resonate well with strong [healthcare provider] recognition,” GSK’s chief commercial officer Luke Miels said on an investor call.

These people are the most vulnerable to RSV and represent 95% of RSV infection-related hospitalizations, Walmsley noted. In a more general older-adult population, Arexvy reduced the risk of developing RSV-related respiratory diseases by 82.6% in a clinical trial.

GSK expects Arexvy will slow down somewhat in the fourth quarter, given the seasonality of RSV and the preventative nature of the vaccine. Still, Arexvy is set to reach blockbuster status in its first year of launch, GSK figures.

The company projects full-year sales will land above 900 million pounds ($1.1 billion) but below 1 billion pounds ($1.22 billion).

As Walmsley repeatedly stressed during the press briefing and a separate call with investors, it’s the first season for any RSV vaccine, and much remains unknown.

For now, GSK is modeling an uptake pattern for Arexvy that’s similar to a flu shot, Miels said. More than 90% the immunizations for older adults are going through the retail setting, rather than in doctors’ offices. And GSK doesn’t expect that to “materially change,” he said.

“We’ll just see what people’s enthusiasm is over the next couple of weeks,” Miels said. “Clearly, awareness is very high, [and] intention to recommend is very high.”

But to GSK, the uncertainty only lies in the short-term prediction for Arexvy. In the long term, GSK is “very certain” that Arexvy will reach more than 3 billion pounds in peak sales, Miles said.

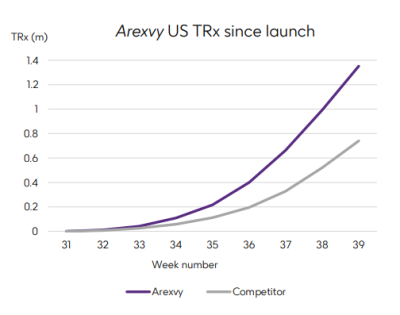

According to a chart Miels presented during the investor call, Arexvy reached about 1.4 million people in the U.S. during the third quarter, while Pfizer’s Abrysvo reached fewer than 800,000. The total population of older adults at risk for RSV is 83 million people in the U.S., Walmsley pointed out.

Meanwhile, Pfizer has one notable advantage over GSK in their RSV battle. Besides the older-adult label, Abrysvo in August won FDA approval as a maternal vaccine to prevent RSV in infants. But the Pfizer shot also needs to compete with Sanofi and AstraZeneca’s antibody Beyfortus, which is given directly to infants.

In contrast to Arexvy’s market-beating performance, GSK’s flagship product, shingles vaccine Shingrix, missed analysts’ consensus by 5% despite a 15% increase at constant currencies over the same period last year.

GSK attributed Shingrix’s underperformance to a decline in the U.S. thanks to a “challenging comparator period in which there was higher non-retail purchasing.”

Miels pointed to a recent commercialization collaboration GSK signed in China with local vaccine giant Chongqing Zhifei Biological Products as a future growth driver for Shingrix. The deal “materially expands the number of Chinese adults who can benefit from Shingrix” and will “accelerate our expectations for Shingrix sales to reach more than 4 billion pounds by 2026,” he said.

Thanks in part to Arexvy’s outstanding showing, GSK raised its full-year revenue guidance. The drugmaker now expects 2023 sales to grow between 12% and 13%, versus 8% to 10% previously. In the vaccines department specifically, GSK expects sales to jump around 20% for 2023.

GSK’s total sales came in at 22.3 billion pounds in the first nine months of the year, including 8.1 billion from the third quarter.