|

| Sprout Pharmaceuticals CEO Cindy Whitehead |

In August, female libido drug maker Sprout agreed to a $1 billion buyout from Valeant ($VRX) that would make it a division of the Canadian pharma run by its current CEO, Cindy Whitehead. Now, though--less than four months later--Whitehead is on her way out.

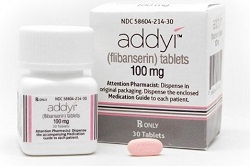

As Valeant spokeswoman Laurie Little told The New York Times in a statement, the drugmaker and Whitehead "mutually agreed that it was the right time to transition to new leadership for the next phase of global commercialization" after assembling a team to take Sprout's "female Viagra"--Addyi--to market.

"Thanks to the efforts of Cindy and her team, Valeant has the opportunity to make Addyi broadly available to patients in need of this important medical treatment," Little said.

Those efforts include winning FDA approval for the treatment, which Boehringer Ingelheim had dropped and the FDA had twice rejected before the agency finally green-lighted Addyi this summer. And striking the pact with Valeant--which Sprout did just one day after winning the regulatory go-ahead--helped lay the foundation for the drug's commercial push.

But so far, the launch hasn't exactly gone the way Sprout and Valeant expected. Between Oct. 17 and Nov. 6, total Addyi scripts had only tallied 227--a far cry from the half a million scripts Pfizer's ($PFE) Viagra posted in its first month after launch.

But so far, the launch hasn't exactly gone the way Sprout and Valeant expected. Between Oct. 17 and Nov. 6, total Addyi scripts had only tallied 227--a far cry from the half a million scripts Pfizer's ($PFE) Viagra posted in its first month after launch.

Of course, there are major differences between the two drugs that make them difficult to fairly compare. Addyi registered marginal efficacy over placebo in trials, and it doesn't provide the immediately obvious effects that Viagra and its fellow ED treatments can. On top of that, the risk of serious side effects netted the med the FDA's black-box safety warning, and doctors must be certified to prescribe it.

Still, though, it's an apparent lack of interest from women that has surprised some industry watchers, especially in the wake of the intense lobbying effort--and media attention--around its approval.

"I thought there was going to be this huge onslaught," Stephanie Faubion, director of the Women's Health Clinic at the Mayo Clinic, recently told Bloomberg. "There have been a few casual inquiries, but no prescriptions yet."

Meanwhile, Whitehead's departure is "also incrementally negative as it could indicate that Valeant is losing some of its senior managers following the recent decline in its stock price," BMO Capital Markets analyst Alex Arfaei told Bloomberg. Shares of the Quebec-based drugmaker have been hit hard on recent government pricing probes and allegations that it used its specialty pharmacy relationships to inflate its top line.

- read the NYT story (sub. req.)

- get more from Bloomberg

Special Report: Pharma's top 10 M&A deals of 2014