GlaxoSmithKline ($GSK) has only just received a thumbs-up from a European Medicines Agency committee for its groundbreaking new gene therapy treatment--but it's already thinking about pricing as it gears up for a final European approval in the coming months.

The CHMP--the safety and efficacy arm of the European regulator--recommended approval of GSK's new drug Strimvelis on Friday to treat the incredibly rare and fatal disorder known colloquially as "bubble boy syndrome," more than a decade after the EMA first granted the drug an orphan designation.

Strimvelis has been developed in partnership with Italy's San Raffaele Telethon Institute for Gene Therapy and works as an ex vivo gene therapy for severe combined immunodeficiency due to adenosine deaminase deficiency (ADA-SCID)--aka "bubble boy syndrome," as children with the disorder must be kept protected from any infections due to their highly fragile immune system.

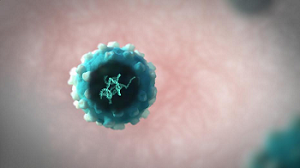

The drug represents the cutting-edge of biopharma science and works by using a virus to insert copies of the ADA gene into stem cells extracted from the bone marrow of patients. The cells are then reintroduced to the patient, who can expect to start making the gene on their own, repairing their immune system.

Bone marrow transplants are the current standard of care for ADA-SCID but only in the minority of cases can this work and only where there is a well-matched donor. Children who are not treated will typically not survive beyond two years.

In the latest study for the drug, 18 children in a trial with Strimvelis were still alive up to 13 years after treatment--with median survival duration of 7 years.

But being at the cutting edge does not come cheap. uniQure's ($QURE) Glybera, which treats the blood-clogging condition called lipoprotein lipase deficiency, was the last gene therapy approved by the EMA back in 2012. Its cost--$1 million per patient--makes it the most expensive drug treatment in the world.

A vector containing the correct copy of a gene--Courtesy of GSK

But could GSK be about to eclipse that price tag? Fiona McMillan, head of specialty franchise, rare diseases and established product portfolio communications for GSK, told FiercePharma that while it will not yet reveal the price, she did say that it will cost "significantly less" than Glybera.

"We're trying to be thoughtful on price," she explained. "So we're trying to create a balance between nurturing innovation and creating value for the healthcare system. I know there are concerns about Europe's first gene therapy approval [Glybera] costing around $1 million, but I can say that Strimvelis will be significantly less than that."

There is no doubt it will end up being a costly treatment, given the fact that there are only around 15 cases of the disorder across Europe each year (and just 350 worldwide), but GSK is keen to tackle that price tag head on, and is looking longer term when it comes to sales.

She said GSK was looking at a number of "different models" on pricing that may include staggered payments across a year. "Whatever we decide, it needs to be fit for the future because from an ROI perspective--well actually, we won't achieve a return for Strimvelis alone, but clearly we're not looking at Strimvelis in isolation. There will be an entire new platform coming from this drug and a set of other possible ultra-rare indications coming through, giving us greater commercial opportunities in the future."

The therapy works as a one-time treatment which takes place over the course of a few months, but McMillan said the plan is not to ask payers to stump up the cost upfront. "This model may also include risk-sharing based on the outcomes for these patients. So if a patient needs to go back onto a different therapy down the line, or if their health declines, we will look at refunding some of the cost."

Launch will come as soon as possible, GSK said, but each treatment will depend on the highly personalized manufacturing method coming from its Italian partner's base, as each therapy must be tailored to the individual patient. GSK does plan an FDA filing in the future, but McMillan says that given the different regulatory rules in the U.S., this will require a different approach to what the firm has done with the EMA.

GSK CEO Andrew Witty

This recommendation will give GSK a much needed boost as it comes after a difficult few years in drug approval terms--and just after the announcement last month that its long-standing CEO Sir Andrew Witty will be stepping down in 2017, after increasing disquiet about his recent performance at the firm.

It also comes a week after the firm announced a radical shift in its patent policy that seeks to encourage copies of its medicines in poorer countries, widening access and possibly diminishing overall costs to medicines, as companies look to change their sales strategy in a global environment that is increasingly seeking better deals.

Novartis ($NVS) is another company seeking a "new way" on pricing and is currently trying a newfangled pay-for-performance deal for its heart failure drug--and much touted blockbuster--Entresto. Two payers, namely: Cigna ($CI) and Aetna ($AET) said last month they had created a "value-based" pricing arrangement with the Swiss drugmaker, which will be based predominately on how well the drug works in the real world.

This all comes as the industry is coming under increasing pressure on pricing, notably in the traditionally laissez-faire U.S. market, which threatens to become a major focus of the upcoming presidential election in the country.