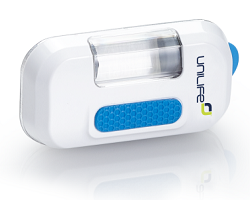

Unilife's wearable Imperium insulin patch pump--Courtesy of Unilife

Struggling injection device specialist Unilife ($UNIS) said in an SEC filing that it needs an additional week to negotiate a deal with potential savior Amgen ($AMGN), which would involve the Big Biotech purchasing up to 19.9% of the company's stock in return for a much-needed cash infusion. If the grand alliance pans out, Amgen would also gain the preferred right of access to new drug delivery platforms and enter into a manufacturing arrangement with Unilife.

In early January, Amgen handed Unilife $15 million in return for nonexclusive access to Unilife's already existing wearable injector devices for use in conjunction with its some of its small- and large-volume drugs. At the time, the two companies said they would exclusively negotiate a grand alliance until Jan. 31.

The Feb. 8 SEC filing extends the negotiating period until 11:59 p.m. U.S. Pacific Time on Feb. 15. A similar 8-K filing was filed on Feb. 1, which extended the negotiating period until 11:59 p.m. U.S. Pacific Time on Feb. 5.

On news of the $15 million payment from Amgen and the possibility of a bigger cash infusion in the future, Unilife shares opened the new year at $1, up from 50 cents. Its shares now trade at 88 cents, at least as of Feb. 8 afternoon.

With a share price in the penny stock range and market cap around $100 million, the initial deal and potential for the sale of 19.9% of Unilife is not a panacea for the company. But it's clear that Unilife has much more at stake during the negotiations than Amgen.

In September, the company laid off 50 employees to focus on commercializing its Imperium line of wearable insulin patch pumps.

Unilife has had some success signing drug delivery partnerships with industry bigwigs, including a deal in November to supply AstraZeneca's ($AZN) Medimmune with wearable injectors for a late-stage monoclonal antibody. And in January of last year, it received $5 million from AbbVie ($ABBV) for the use of its devices in therapies to treat autoimmune diseases.

- read the form 8-K SEC filing