|

How often does one drugmaker sue another for false advertising? Well, GlaxoSmithKline ($GSK) did just that after Teva Pharmaceutical Industries' generic copy of Wellbutrin XL went up in flames. Teva moved onto the market with a substandard product, pretended it was equivalent to the brand, and stole away billions in sales, GSK's lawsuit contended.

Now, a federal judge says Teva ($TEVA) has to fight GSK's claims. And that includes a demand for hundreds of millions in lost profits.

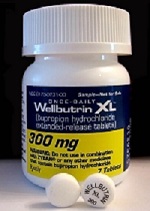

The lawsuit involves Teva's 300-mg Wellbutrin XL copy, which the FDA forced off the market in 2012. That ignominious end came years after an auspicious beginning. The Israeli generics maker launched the pill under its own brand name, Budeprion XL, in December 2006, and armed with 6 months of generics exclusivity, Teva quickly siphoned off branded sales.

Soon after, patients started complaining that the generic didn't work as well as the branded version, GSK's lawsuit states. One pharmacy even commissioned its own tests of the generic and concluded that Teva's XL formula didn't release the active ingredient at the same rate as the branded formula did.

But Teva and its partner, Impax Laboratories, "stonewalled any scientific inquiry" into their version of the drug, claimed to be conducting a study to demonstrate its equivalence, and repeatedly said it was as effective as Wellbutrin XL, the lawsuit states. The FDA actually had ordered the two copycat drugmakers to conduct a study, but the companies at first dragged their feet and then didn't recruit enough volunteers, the suit claims. "All the while, Teva ... continued to advertise that its product was a safe and effective alternative to GSK's Wellbutrin XL," the suit says.

Fast-forward to October 2012, when the FDA did its own tests and determined that Budeprion XL was not, in fact, bioequivalent to the brand. Teva pulled its version from the market. Glaxo sued four months later in Pennsylvania federal court, and Teva asked the judge to throw out the lawsuit. The generics maker said that, because the FDA had approved the generic, its own statements about Budeprion XL's bioequivalence couldn't be considered false.

No such luck for Teva. Judge Eduardo Robreno refused to dismiss the case, saying that the FDA's initial approval for Budeprion XL doesn't preempt Glaxo's claims that Teva made false statements about its bioequivalence. Glaxo also accused Teva of making other false statements that had nothing to do with the FDA's initial blessing of the product, Robreno decided.

Whether Glaxo ultimately prevails--and collects--may not be clear till next year. According to the court docket, the next round of motions are due by April 6, and Robreno ordered discovery to wrap up by June 2015. Ironically enough, if Glaxo does indeed reap any recompense, it would be the first Wellbutrin-related revenue the company books in years. The company sold the rights to Wellbutrin to Biovail, now Valeant Pharmaceuticals, in 2009 for $510 million.

Meanwhile, the Wellbutrin XL snafu has prompted the FDA to take a closer look at its generics approvals. Last month, the director of the FDA's Office of Generic Drugs said the agency is spending $20 million to test certain copycat drugs to see whether they work as well as the brands they mimic.

Special Report: Top 10 generics makers by 2012 revenue - Teva | The top 10 pharma companies by 2013 revenue - GlaxoSmithKline