India wants to cap drug prices at home while ramping up sales of generics to Western markets targeting the U.S.--all while dozens of manufacturing plants are under regulatory scanners on quality and testing.

|

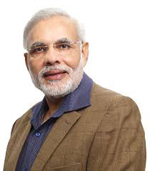

| Indian Prime Minister Narendra Modi |

According to the Hindu Business Line, those opposing forces have brought greater pressure on Indian companies to untangle regulatory hurdles at home and possibly push for wider understanding on market access issues.

Noting that multinationals face pricing and patent challenges in India, Business Line also said domestic companies face a quality perception issue that hinders rapid growth in the U.S. and elsewhere where governments are struggling to contain costs.

To be sure, the domestic and multinational companies have wide disagreements on intellectual property laws. But they do increasingly share concerns in India on pricing that may form the basis for a less confrontational approach to access issues.

At the top of the list for both domestic and multinational companies in India are moves by the National Pharma Pricing Authority to cap prices for drugs and expand the list of items covered under the essential medicines list, such as cardiovascular drugs, Business Line said.

In July, a domestic industry-sponsored study by IMS Health Information and Consulting Services India slammed the policy as not meeting goals of wider access for the poor, while diminishing scope for quality and innovation.

India follows a market-based price system, the Drug Price Control Order, launched under the previous Congress Party-led government in 2013 that put around 650 drugs under a price ceiling aimed at ensuring access for poorer patients.

The Organisation of Pharmaceutical Producers of India (OPPI) and other stakeholders said measures focused on price control have a limited impact and do not improve access.

Though indirectly related, Section 3(d) of the Indian Patent Act (1970) has been used by the Indian Patent Office to deny patents on cancer drug Glivec/Gleevec from Swiss-based Novartis ($NVS), among others, citing cost and access as a goal.

But last month, domestic industry advocate the Indian Pharmaceutical Alliance and staunch challenger Natco Pharmaceuticals dropped opposition to the patent application for Gilead's ($GILD) Sovaldi (sofosbuvir), as a unique licensing and manufacturing pact appears solidly backed by all generics companies.

In January of last year, the alliance filed a pregrant opposition, followed by Natco in April, for an application filed in October 2009. Last week, the Business Standard noted that India's Patent Office disposed of both challenges and the application is still pending.

Business Line said for its part, domestic industry could step up efforts at greater quality control that could help Indian companies generate cash flows that would see them move from generic drugs to biosimilars, changing the manufacturing model into one that is more cash-intensive to start but has a potentially bigger payoff.

Business Line said local investors see a big opportunity for companies to export pharmaceutical products but noted that worries persist as a sustained stepped-up inspection regime by the U.S. FDA has caught many drugmakers on "the wrong foot" and threatens an opportunity for growth.

- here's a Business Line story on risk and one on investing