|

| AbbVie CEO Richard Gonzalez |

Monday, Shire ($SHPG) laid out its justification for staying independent, eager to ward off circling suitors. Now, AbbVie ($ABBV), which has already made three passes at the Irish drugmaker, has laid out its own case for a takeover.

Wednesday, the Abbott Laboratories ($ABT) spinoff cited accelerated growth, broadened global infrastructure and a deeper pipeline as benefits of a merger with Shire. Not to mention a host of reasons it would make a good merger partner.

The deal would give Shire's rare disease and neuroscience franchises a boost, what with AbbVie's global reach, CEO Richard Gonzalez figures. The company operates in more than 170 countries, and it has the R&D, commercial and manufacturing infrastructure to herd Shire's products along, he said in a statement.

But Shire is touting those same franchises as keys to its independence. CEO Flemming Ornskov has promised to more than double the company's top line within 6 years to $10 billion. A lofty goal, but analysts have said it's achievable, thanks to Shire's "dominant positions in very attractive niche markets," as Edison Investment Research analyst Dr. Mick Cooper put it in a statement earlier this week. Those include its foothold in rare diseases such as hereditary angioedema, which it strengthened last year with its own $4.2 billion deal for ViroPharma.

|

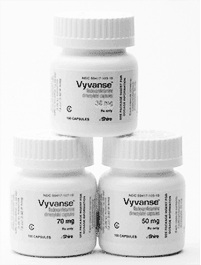

That's not to leave out Shire's flagship ADHD meds, which still bring in the bulk of its sales. Lead drug Vyvanse, a blockbuster with $1.2 billion in 2013 sales, boasts patent protection until 2023, and just Wednesday a district court judge backed up the drug's IP shield.

And though the company is in the middle of a restructuring with an eye on diversification, Vyvanse still has room for growth: Shire recently agreed to test the drug in preschoolers in exchange for a 6-month pediatric exclusivity extension on its patents.

All of that taken into account, AbbVie will have to raise its latest bid--which totaled about $46.5 billion--to $51 billion if it wants to win Shire over, according to analyst estimates compiled by Bloomberg.

"It's all about a price," Panmure Gordon analyst Savvas Neophytou told the news service. "I personally think this deal will get done."

- read AbbVie's release

- read Shire's release

- get more from Bloomberg

Special Reports: The 10 best-selling drugs of 2013 - Humira | Pharma's top 10 M&A deals of 2013 - Shire/ViroPharma | 15 Highest-Paid Biopharma CEOs of 2013 - Richard Gonzalez - AbbVie