The market for Omega 3-based prescription drugs was just a one-drug wonder. GlaxoSmithKline's ($GSK) Lovaza, designed to lower triglyceride levels in patients with cardiovascular disease, was all by its lonesome there, with £584 million, or about $1 billion, in 2013 sales.

The market for Omega 3-based prescription drugs was just a one-drug wonder. GlaxoSmithKline's ($GSK) Lovaza, designed to lower triglyceride levels in patients with cardiovascular disease, was all by its lonesome there, with £584 million, or about $1 billion, in 2013 sales.

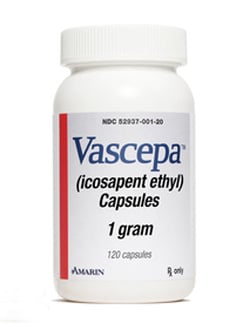

That was just a few months ago. But now, there are not only two more fish-oil-based brands--Amarin's ($AMRN) Vascepa and AstraZeneca's ($AZN) Epanova--but a generic version of Lovaza, too. And all four are looking for their share of a market that is still more potential than actual.

So what do the new kids on the block do? Sign up a celebrity pitchman, if you're Amarin, which is still scrambling for a real foothold. As Medical Marketing & Media reports, the company has tied up with the host of the cable TV show Pawn Stars, Rick Harrison, in an integrated campaign run by Makovsky as agency-of-record. The campaign follows Amarin's co-promotional deal with Kowa Pharmaceuticals, which created a sales force of 380 reps to take advantage of any DTC buzz.

Vascepa is the real deal, Harrison suggests in a video on the site LowerMyTrigs.com. Just as he focuses on value and authenticity when buying merch for his shop, he's turning to the prescription pill--not an over-the-counter supplement--to lower his triglycerides. Harrison also touts something that Amarin considers key to Vascepa's profile: It doesn't tend to raise "bad" LDL cholesterol as Lovaza can, the company says.

|

| Rick Harrison |

AstraZeneca, meanwhile, is telling a fish story in its unbranded digital effort. As MM&M reports, AZ has posted three videos in its "Take It from a Fish" series, putting words about healthy eating habits into a few talking fishes' mouths. The awareness campaign is now on YouTube, and it will fan out across various digital channels, including social media.

As for Teva Pharmaceutical Industries' ($TEVA) generic version of Lovaza, it won approval in April and launched soon thereafter. Its marketing hook--price--doesn't require DTC advertising.

The original brand is hanging in there, despite the earlier-than-expected generic competition. Glaxo did take a charge against 2013 earnings for "partial impairment" of the Lovaza brand, anticipating Teva's generic launch. Its first-quarter sales didn't match up to 2013 levels, but still amounted to about $175 million.

- read the MM&M story