|

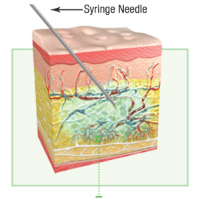

| A depiction of the subcutaneous space following injection of Haloyzme's Enhanze enzyme--Courtesy of Halozyme |

The drug delivery landscape is littered with platform technology companies that fail to achieve commercialization or find a partnership. San Diego's Halozyme ($HALO) is not one of them.

Last year it added its sixth Enhanze collaboration with biopharma bigwigs, adding Eli Lilly ($LLY) to the list of companies hoping to move from infusion to subcutaneous injectable formulations, in a deal potentially worth more than $500 million. It also borrowed $150 million against royalties from commercialized subcutaneous meds sold by Roche ($RHHBY) and Baxalta ($BXLT).

At San Francisco's annual J.P. Morgan Healthcare conference, the company focused on its internal lead candidate to treat metastatic pancreatic cancer, PEGPH20. The company announced progress on the candidate's companion diagnostic, being developed with Roche's Ventana Medical Systems, saying that based on the cut point of the now finalized scoring system of 35%-40% of metastatic pancreatic cancer patients have tumors with a high level of hyaluronan.

Hyaluronan is the sugar molecule that the Enhanze platform degrades, thereby enabling subcutaneous delivery for its partners. In the case of certain cancer tumors, the company says breaking down hyaluronan increases blood flow of co-administered therapies to the tumor. Intravenous PEGPH20 is being tested in conjunction with Celgene's ($CELG) Abraxane and gemcitabine.

Halozyme provided an update on the looming Phase III trial. It said it has selected about 200 sites in 20 countries in the Asia Pacific, Europe and the Americas. The company expects to present progression-free survival data from the ongoing Phase II trial in Q4 2016.

Halozyme expects 2016 revenue of $110 million to $125 million, excluding any new Enhanze collaborations that may be signed. Note that last year's deals with AbbVie ($ABBV) and Eli Lilly ($LLY) added $48 million that was not included in the 2015 guidance.

Meanwhile, operating expenses are projected to be $240 million to $260 million, due to the cost of R&D associated with PEGPH20, which is also being studied as a treatment for lung, gastric and breast cancer.

"We enter the year with great momentum in our expanded PEGPH20 clinical program and with our collaboration partners, including achieving targeted enrollment in our Phase 2 study in pancreatic cancer patients and signing our sixth Enhanze global collaboration and licensing agreement through the Lilly relationship we announced last month," said Halozyme CEO Dr. Helen Torley, in a statement. "In 2016, we will continue to invest to advance our study of the pan-tumor potential of PEGPH20, and to further expand the value of our growing Enhanze franchise."

- read the release

Special Report: FierceDrugDelivery's 10 biggest partnerships in drug delivery - Johnson & Johnson-Halozyme