What's a blockbuster market worth? In the case of cancer treatments, the answer will soon be $100 billion. According to a new study by the IMS Institute for Healthcare Informatics, global oncology spending hit $91 billion last year, and it's growing at a 5% clip annually.

What's a blockbuster market worth? In the case of cancer treatments, the answer will soon be $100 billion. According to a new study by the IMS Institute for Healthcare Informatics, global oncology spending hit $91 billion last year, and it's growing at a 5% clip annually.

That's a simple summation of the cancer market. Behind those numbers, the story is much more complicated. There's a tug-of-war between insurers and companies, governments and cost watchdogs, prices and value, mature markets and emerging countries, innovation and cost cuts, cheap generics and cutting-edge spendy treatments.

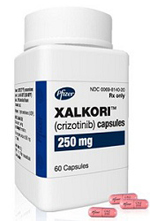

As IMS Health notes, prices are way up. The number of targeted cancer treatments--and of new cancer meds in general--has multiplied in recent years. Targeted drugs, such as Pfizer's ($PFE) lung cancer therapy Xalkori and Roche's ($RHHBY) melanoma drug Zelboraf, cost more than generalized drugs because they're meant for smaller patient populations--and they now make up 46% of cancer sales, a huge leap from just 11% a decade ago.

Other new cancer drugs may not be aimed at genetic targets, but they're still expensive: Think Bristol-Myers Squibb's ($BMY) melanoma drug Yervoy, the first new treatment for that devastating disease in decades; its price tag on launch was a whopping $120,000.

|

| IMS Health SVP Murray Aitken |

No wonder the overall cost for cancer treatments per month in the U.S. is now $10,000, up from $5,000 just a year ago, IMS Health SVP Murray Aitken said during a conference with reporters.

Payers don't like this trend. In top cancer markets such as the U.S. and Europe, governments and private insurers are applying new pressures to cancer drug prices.

In the U.K. and other top European markets, cost-effectiveness watchdogs have been tough on new cancer treatments, skeptical of small improvements in survival time and willing to play pricing hardball. Roche's hot new armed-antibody treatment for breast cancer, Kadcyla, recently got the stiff-arm from the U.K.'s National Institute for Health and Care Excellence. In the U.S., doctors worried about costs aren't waiting for officialdom to move on prices; the American Society of Clinical Oncology has its leaders working on a framework for doctors to use in selecting drugs and explaining costs to patients. And private insurers are raising new questions about the value of new treatments.

In the developing world, governments aren't stopping there. They're demanding big-time price cuts, or else. India, for instance, has allowed a domestic drugmaker to roll out a cheap generic of Bayer's kidney cancer treatment Nexavar, and may use the same tactic for a handful of other Big Pharma meds, including Bristol-Myers' leukemia treatment Sprycel.

The good news for payers--if not for drugmakers--is that growth in cancer spending has slowed a bit. From 2003 to 2008, the oncology market grew by more than 15% per year, almost three times the growth rate IMS Health found for 2008 through 2013. The good news for cancer drugmakers is that, slowing growth or no, oncology is expected to be far and away the biggest therapeutic class in 2017, with $74 billion to $84 billion in sales in development markets--more than twice the spending on diabetes, the second-place class.

That's why drugmakers won't be deterred by pressure from payers, doctors, or anyone else. The payoff is too promising for that. And when a market approaches $100 billion, even 5% growth is worth billions.

- read the IMS Health release

Special Report: The 10 best-selling drugs of 2013