|

| Kyle Bass |

On his first trip up to the patent-office plate, Kyle Bass struck out. A U.S. review board nixed the hedge funder's challenge to two Acorda Therapeutics patents, sending the drugmaker's shares soaring--and showing Bass that his short-selling crusade against "low quality" pharma patents won't be an easy home run.

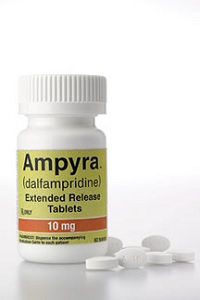

The Coalition for Affordable Drug Prices, started by Bass, had targeted Acorda's ($ACOR) IP protection on Ampyra, a drug used to help multiple sclerosis patients walk better. The group petitioned for an inter partes review of two Ampyra patents. And in two written decisions posted Monday, the U.S. Patent and Trademark Office's review board said the challenges weren't strong enough to warrant further action.

It's a relief for Acorda, whose shares plummeted when Bass chose Ampyra as his first patent-challenge target. At the time, the company was already facing patent battles with a variety of generics makers, so the drug looked as if it might be vulnerable under the new IPR challenge process.

In fact, analysts estimate that more than half of Acorda investors expected the patent office to at least consider Bass' petitions in a formal review process. And Ampyra is Acorda's key product, with projected 2015 sales of up to $420 million.

In fact, analysts estimate that more than half of Acorda investors expected the patent office to at least consider Bass' petitions in a formal review process. And Ampyra is Acorda's key product, with projected 2015 sales of up to $420 million.

"We're extremely gratified by the patent office's decision denying institution," Acorda's lawyer, Gerald Flattman of Paul Hastings, said in a statement. "It further validates the strength of Acorda patent portfolio protecting Ampyra."

For Bass, it's something of a reality check. The Texas hedge funder came out with guns blazing against pharma patents early this year, promising doom for drugmakers with patents he considered weak. After his first IPR filings against Acorda, Bass and his coalition went on to challenge patents on Biogen's ($BIIB) MS treatment Tecfidera; Johnson & Johnson ($JNJ) and AbbVie's ($ABBV) blood cancer med Imbruvica; and Shire's ($SHPG) gastrointestinal meds Lialda and Gattex, among others. He's racked up 20 challenges in all.

The PTO's decision not to review the Acorda challenges show the IPR process won't be easy. In fact, Bass' very public challenges could work against him--particularly given the fact that he's made no secret of his plans to make money off the IPR process, by shorting the shares of companies with so-called "weak" patents.

Celgene ($CELG) lambasted Bass in its response to a challenge against Revlimid, telling the patent review board that he and his partners are simply aiming "to line their own pockets at the expense of public pharmaceutical companies and their shareholders." In its own response to Bass, Acorda echoed that idea, saying that Bass' use of IPR to "manipulate financial markets" doesn't fit Congress' intentions in setting up the process. Industry trade groups PhRMA and BIO have already asked Congress to help them thwart Bass by making changes to the IPR process.

Leerink Partners analyst Paul Matteis figures that, in light of all that argument, the Ampyra decisions will ease investors' minds in the other IPR cases, too. "Legally, PTAB is not supposed to consider the intention or identity of the filing party in its analysis, and each IPR is supposed to be evaluated on its own merits," Leerink's Matteis said in an investor note. "However, the media and political attention surrounding the Bass IPR may be hard to ignore."

- see the Acorda release

Special Reports: Top 10 best-selling multiple sclerosis drugs of 2013 - Ampyra